One of the most widely used property management and accounting software for HOAs and Condo Associations to date has been Tops Pro. This software is being discontinued, and will not be supported past the end of 2024. If your community is currently using this software, what does Tops Pro and IQ discontinuing by the end of 2024 mean for you – and what is your plan going forward?

Tops Software History

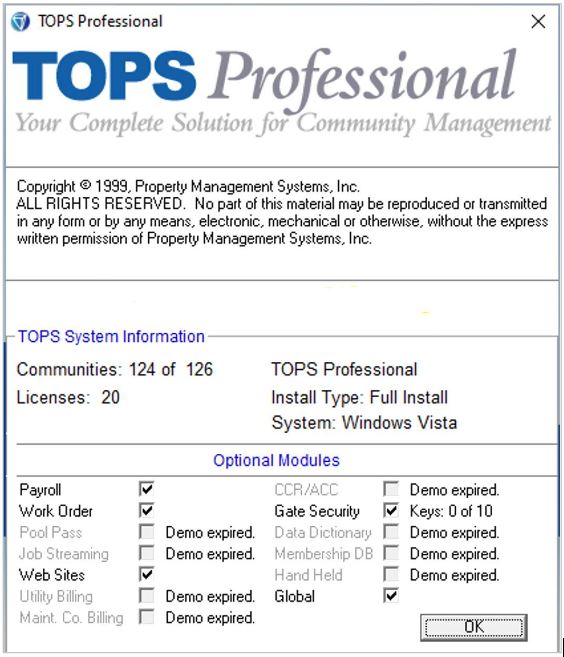

Starting as a DOS-based system in the 1970s, Tops Software transitioned through various phases, including a move to Windows 3.0 in the late 80s and 90s, rebranding to Tops 2000 around Y2K, and evolving into Tops Professional (Tops Pro) by 2008, with the addition of Tops IQ in 2010. We’ll refer to these collectively as Tops Pro. For Property Management Systems, the version of Tops Professional we use shows a copyright date of 1999:

The Tops Pro program was simple and affordable, with an initial cost and then a low annual maintenance fee, which allowed it to grow its market share to be the most widely used software program in the HOA & Condo Management industry. Its tag line was “Your Complete Solution for Community Management”, and the software had optional add-on modules for purchase such as work orders, gate security, pool passes, CC&Rs.

Within the last two years, Tops sold a large ownership stake to a private equity company and has invested in Tops One, a cloud-based application, rebranding the company as Enumerate. Cloud software has a different pricing model – a monthly recurring fee based on the number of doors with a minimum cost. Of course, the software industry likes monthly recurring revenue versus a modest annual fee. Part of this discontinuation is to help move legacy customers on to a recurring revenue model.

Although cloud software is more expensive, it has many advantages over install-based software as explained later in the article.

What Happens to Software When it is No Longer Updated & Supported?

I asked an industry software expert a few questions.

- Would you share with me what it means if the software is no longer updated and supported?

“A software company doesn’t want to have the cost of maintaining multiple versions, nor the cost to add new features to two systems. But when software is no longer updated and supported it means they won’t develop anymore on that platform – which also means no security updates. Vulnerabilities in software are being exploited more today than ever before. Any hope in protection against hackers is essentially gone. They simply will not put money into something they are shelving in under a year. Also, it gives Tops/Enumerate more leverage to get people to move to their other offering.

It is important to note, there are many people who were told that Enumerate could easily transform their data from TOPS Pro to their newer system since they own the data. This has proven to be much more difficult than it was portrayed, and has resulted in many frustrated customers. Several have abandoned the transition and either went back to TOPS Pro, or moved to other systems.”

– How does this affect people who wish to continue to stay on TOPS Pro?

“As long as you are happy with the product as it stands today, you can get by for another year or so. Just don’t expect getting any help with set up or issues that come up.

Over time it will probably break, but it can go on for a while. There are always bugs in software, no matter how good it is, and when you find yourself in this situation you may be stuck and don’t have support to get you through.”

By far the biggest concern with TOPS Pro is the elimination of security patches.

In Traveler’s insurance 5 Cyber Readiness Practices to boost your cybersecurity it says: “since hackers often target outdated software and systems #2 on their list is to update your systems, updates contain important security patches that address known vulnerabilities”.

When Tops/Enumerate stops doing this to Tops Pro these systems will be at risk and include association tax IDs and bank account information. Some may include homeowner ACH information, contact information and other data. Most hackers are hoping their malicious code makes it into larger organization infrastructures, but it will be easier for their code to compromise older systems.

Once they discover that your systems have critical banking information stored on your outdated servers running at your office, they won’t hesitate to take full advantage of it.

The Benefits of Switching to the Cloud or Newer Software

There are several benefits of using browser- or cloud-based software, including:

- No need to maintain a server, backups are handled by the software company automatically,

- Security & enhancement updates happen automatically (due to this it is more secure from ransomware attempts),

- It always has power (no disruption from local power disruptions),

- It is not susceptible to viruses when someone clicks on something they shouldn’t,

- All required parties including homeowners, boards, management, lawyers, drivers, vendors, etc can access the software from anywhere at any time (outside of maintenance windows),

- Integration with other systems are typically far greater and deeper, and

- Service is typically better because they earn your business monthly rather than yearly.

General Feedback from Tops Pro as a Software

I asked a number of people, from board members and managers to software and banking executives, and here is what they had to say about Tops Pro as a software:

General thoughts on Tops Pro as a software?

“Was fairly stable until we ran into bugs and didn’t like how fixes were managed. When we updated to a different version we lost some data, or ran into corrupt files during the conversion process, so we had to manually enter data such as AR transactions – otherwise, it has been a pretty good software program for many years.”

Anything that made it tougher for boards of directors to use?

“It had all the main features – was not a fan for internal usability and GUI – VMS software has that issue as well. Most of the newer software programs have an updated Graphical User Interface (GUI).”

Board members have also told us that Tops Pro is cumbersome, limited, outdated, and is not intuitive so it takes a long time to find/ look up info if not familiar with using it.

From a Banking Integration Standpoint

There is no banking integration like an API that has automated tasks. This is an old system and adding banking transactions into it is a manual operation. A flat file needs to be uploaded on a daily basis – someone has to create a file, download a file, save the file upload into system, and then store all that information on your servers – which can be hacked, and then critical data is at risk such as the community’s bank account numbers.

Newer software has the ability to automate some tasks, so there is less risk of them not happening on time or happening late if someone is out of the office. This includes lockbox validation file, lockbox payment posting, check images, bank balances, statement images, more automated bank reconciliation, also keeps lockbox data secure, positive pay check fraud protection.

Tops Pro does Not Have These Additional Features that Newer Software Have

1 – emailed statements don’t work consistently and are not always delivered – can see in communication history if was sent and the emails sent to but can’t see if it was opened/ read or bounced in the software

2 – there is not a place to save emails to a homeowners account

3 – homeowner can’t update their contact info

4– no ability for homeowner to look up their balance

5 – no native ability for homeowner to make an online payment

6 – board member needs to use VPN and get a login to have access to the software (not cloud /web based)

6a – if no VPN then no portal / visibility for Board to see accounting info in the system

7 – no ability to house documents / have restricted folders / allow board & homeowners to access

8 – no built-in communication tools for email, text, voice broadcast

9 – no mobile app

From an Accounting Perspective:

Comments from Bookkeepers Using Tops

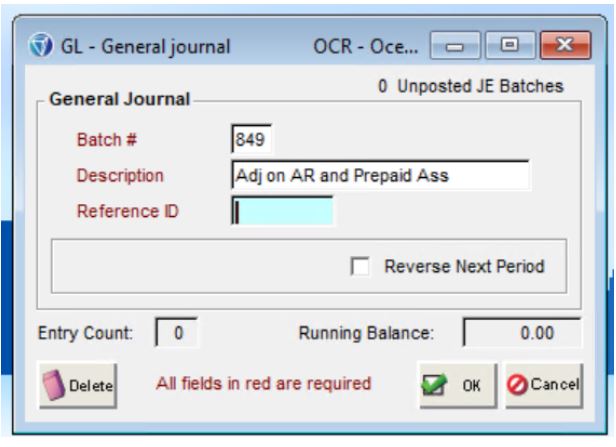

Patricia (Sr. Bookkeeper) – Having not worked in TOPS in almost nine years I would have to say that “cumbersome” is an understatement – it is archaic! I believe you are right on items three & seven. Reports are very slow to load. Accounting errors are difficult to fix and require journal entries to correct where many of the newer systems allow you to delete and repost, leaving a much cleaner general ledger. TOPS does not always allow you to pick a date when something is going to happen, for example voiding an invoice – it posts the day you void it, not the month you want it voided in, so more Journal Entries are needed to correct. You cannot edit a Journal Entry- you have to do additional entries to adjust. In the newer systems, if an invoice posts to the wrong GL, most of them allow you to go into AP to reclass, TOPPS requires Journal Entries. Lots and lots of journal entries!

Some of the newer systems offer some really cool features. The last system I worked in, Vantaca (which I would not recommend), you could pull up an Income Statement, click on a line item in the YTD column, and see everything posted to the GL all year. The newer systems make research much easier. Most of the newer systems also allow the Boards to view reports through the portal so they can access themselves rather than requesting from us.

Reports are limited.

I believe you are correct on the Compliance issues as well – the new systems allow you to save the letters sent out so that you have them available if you need to resend or send to the Attorney.

It is slow, tedious, inefficient, and outdated.

Mevelyn (Sr. Bookkeeper)

1.) Copy of the invoice is not Integrated to the GL Activity Report (this is what I loved most in Smartwebs – you can view directly the copy of the Invoice should there be attachment to the Invoice- for easily viewing of transactions) in Tops you have to emailed the AP team for the copy of the invoice and wait for them to send it before you can check the transactions do post an adjustment/reclass if needed.

2.) Yes, it is archaic in terms of typing a description on the JE – it only enables you to type 25 characters, thus most of the time when posting JE it’s like doing an old telegram – you have to add a lot of abbreviations in order to give a clear description. (It is critical to include a detailed description of the entry to remember why it was placed.)

3.) Time consuming in Generating Financial Reports – because they were not all in one place

From another Sr. Bookkeeper

What are the main weak points / missing features of Tops Pro versus new software?

Missing feature easy date corrections on AR, AP AND GL

What did you like about it? Easy to understand.

What did you dislike about it? No JE easy corrections / removal of transactions like in newer software

What Are Your Options?

1 – Choose a property management or accounting company with newer software

If you are working with an accounting or management company now, they may have a transition plan to a newer software. Look at the software being offered, read online reviews and see if it meets your community’s needs. Also, you can evaluate the service you are getting now, see what issues may be caused by using old software and processes and decide what you want to do. New software will help some but won’t change the company’s staffing or culture of customer service to be responsive to you.

If you find that your current HOA accounting or management company is not meeting your Board’s standards in responsiveness, consider making a change to self-management with the support of a trusted HOA accounting company such as Community Financials.

2 – Buy software, configure it and then use it monthly for accounting and operational items

If you are self-managing or a property manager, you have many options. Here are a few of the main software programs we have used or come across:

Recommended: Smartwebs – board members say this software is intuitive and easiest to use. It got its start making Violations, ARC approvals easier and plugged into some of the software above. They now offer accounting and have one login for boards and managers to use the functionality of the software. As a note, this is the software that Community Financials uses and switched from Tops One, Tops Pro and Caliber to this platform. (this software cost is included in our monthly accounting price). To read more click here: https://communityfinancials.com/best-software-for-managing-your-self-managed-or-hybrid-managed-hoa-or-condo/

Other Options Include:

Quickbooks – can read our blog post on the limitations of QuickBooks for condominium and HOA bookkeeping and accounting https://communityfinancials.com/limitations-of-quickbooks-for-condominium-and-hoa-bookkeeping-and-accounting/

Tops One/Enumerate Central – Tops’ cloud software – Our company has used this for 5 years. It is usablebut can be expensive, as well as having some limitations such as add-on portals that sometimes do not sync with the main software, causing issues. One Board member described it as “a little clunky but ok”.

Caliber/ Frontsteps – good software. Good job with accounting. Native portal had issues. The feedback we heard from customers was that the property management tools were hard to use. The collection process was also difficult to set up.

Vantaca – meant for very large management companies – very complicated set up – but can see all emails to a customer in the software.

CINC – strong accounting; board members need a second login to use other property management features. This software, like most, was designed to be used by large management companies.

3 – Hire a financial manager to do the monthly accounting, with management software included

If you are like most of our customers, you likely don’t really want to do the accounting yourself – it may not be your strong suit, or the best use of your time, especially as a volunteer. Managers using our services don’t want to manage accounting and accounting staff and instead stick to their strengths. Some communities split the accounting from the physical management and get better results from focused specialists. In any case you may not want to handle homeowner accounting emails and phone calls.

Instead, you can hire a HOA or Condo Financial Manager to do the monthly accounting, customer service, resale paperwork, and provide other remote services. Take a close look at the software these service providers use and if you can get additional management tools like maintenance and violation tracking, and a simpler way to handle ARC requests. These systems also have the ability for the boards to store and share documents, send email or text message blasts. The software cost is included in the monthly accounting price so the community can save money. It is more affordable than your community paying for software with a single license. If this sounds good to you, then you can look into working with a HOA or Condo Accounting Partner.