The 4 Best Condo Community and HOA Financial Reports

I hear it all the time, the board gets a stack of condo or HOA financial reports but doesn’t look at them. The reason why? I suspect information overload and not knowing what to look for in each report. It can be overwhelming for a community board member that isn’t used to looking at financial reports. So how about if you only needed a handful of reports to look at – it would make it simpler and take less time to get a picture of your association’s financial health. So the following is our top 4 financial reports for HOAs and condo communities.

As a board member you have a fiduciary responsibility to exercise due care and diligence when overseeing the community and its funds. The following four condo / HOA financial reports are vital tools for protection of association assets, control and planning.

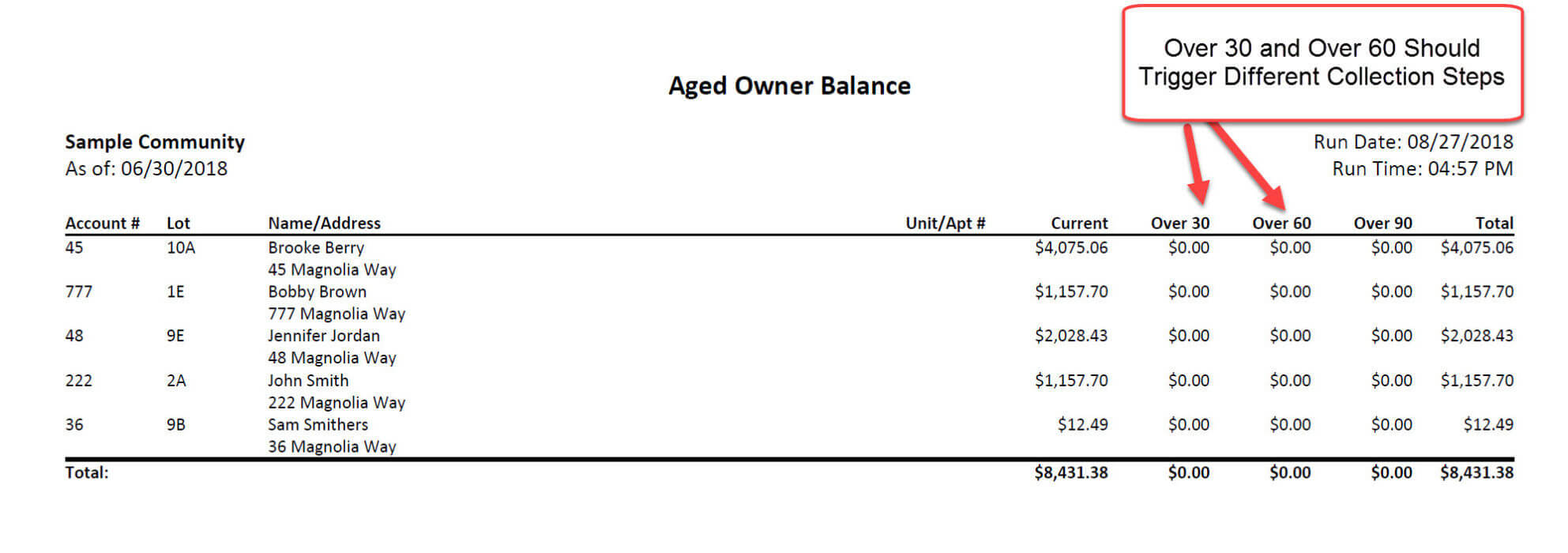

HOA Financial Report #1 – Aged Delinquency Report

This aged delinquency report/ aged owner balance report shows who is behind in their assessments. Different reports can also break out the delinquency by type of charge owed (assessment, late fees, etc). The board needs to review this at every board meeting to see what action needs to be taken at certain late dates (30, 60 days) like sending a demand letter or turning the account over to a collection attorney or agency. If you get behind in collections it can cause a problem with services at your community and worse you may not be able to collect the entire past due amount depending on your state laws and how long it took you to commence a legal action. Some states only guarantee collection of 9 months past due assessments and it takes a few months for the action to work itself through the courts so if you are owed a year you may only get 9 months – ouch!

Sample Aged Delinquency Report

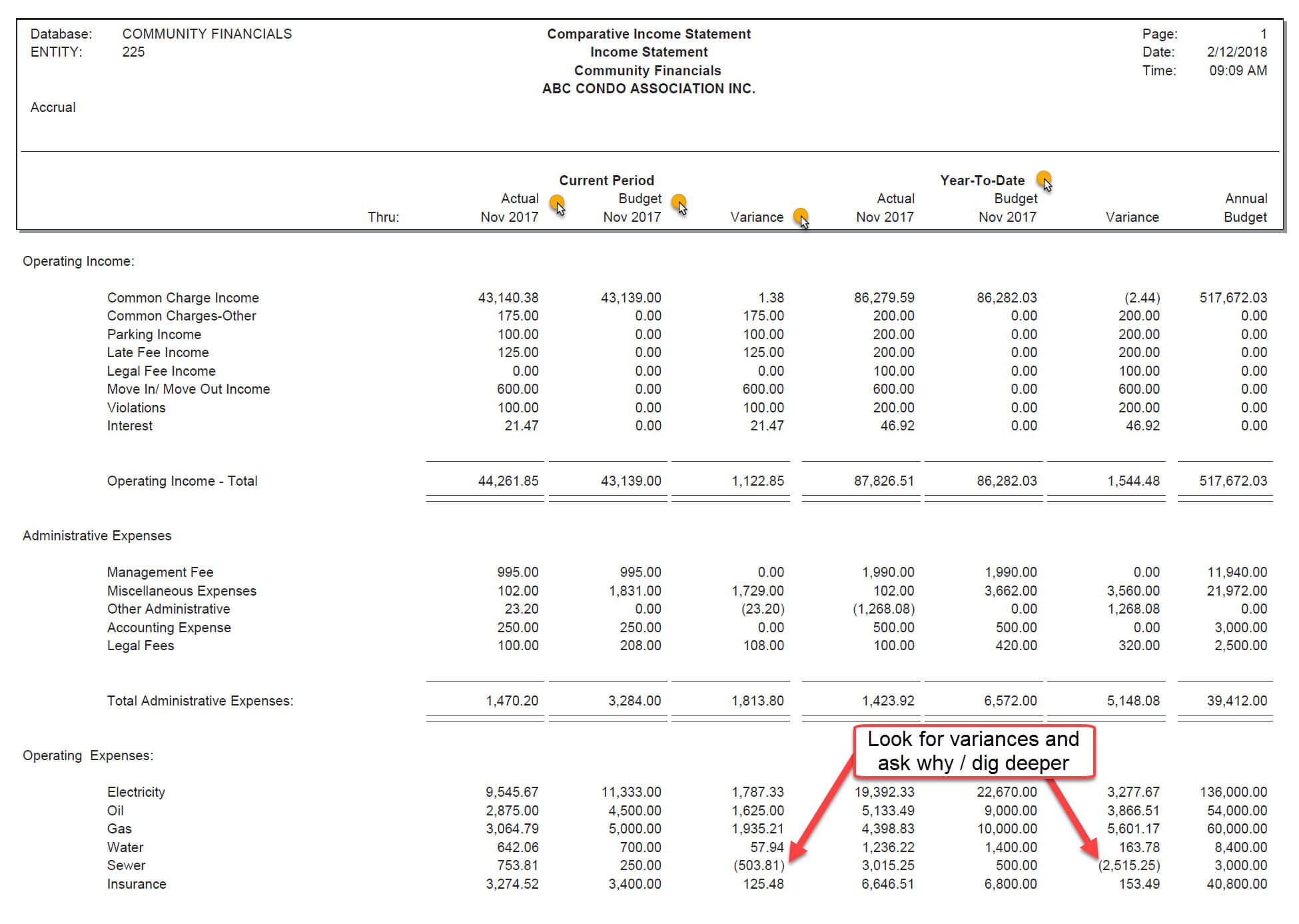

HOA Financial Report #2 – Comparative Income & Expense Report

This is my favorite report to run the association. The Income Statement is meant to inform how the association is doing compared to budget. It shows the current period actual expense, budgeted expense and any variance between the two. It also shows the same thing for the year to date. When you see a variance it is a warning flag to ask why and dig deeper. It can also allow you to make up any shortfall quickly so you don’t cripple your community’s cash flow and vendor payments. For example if you are spending more on snow removal than budgeted due to an extreme winter you can do a special assessment right away to cover the shortfall while it is still cold and owners are more understanding.

Sample Comparative Income & Expense Report

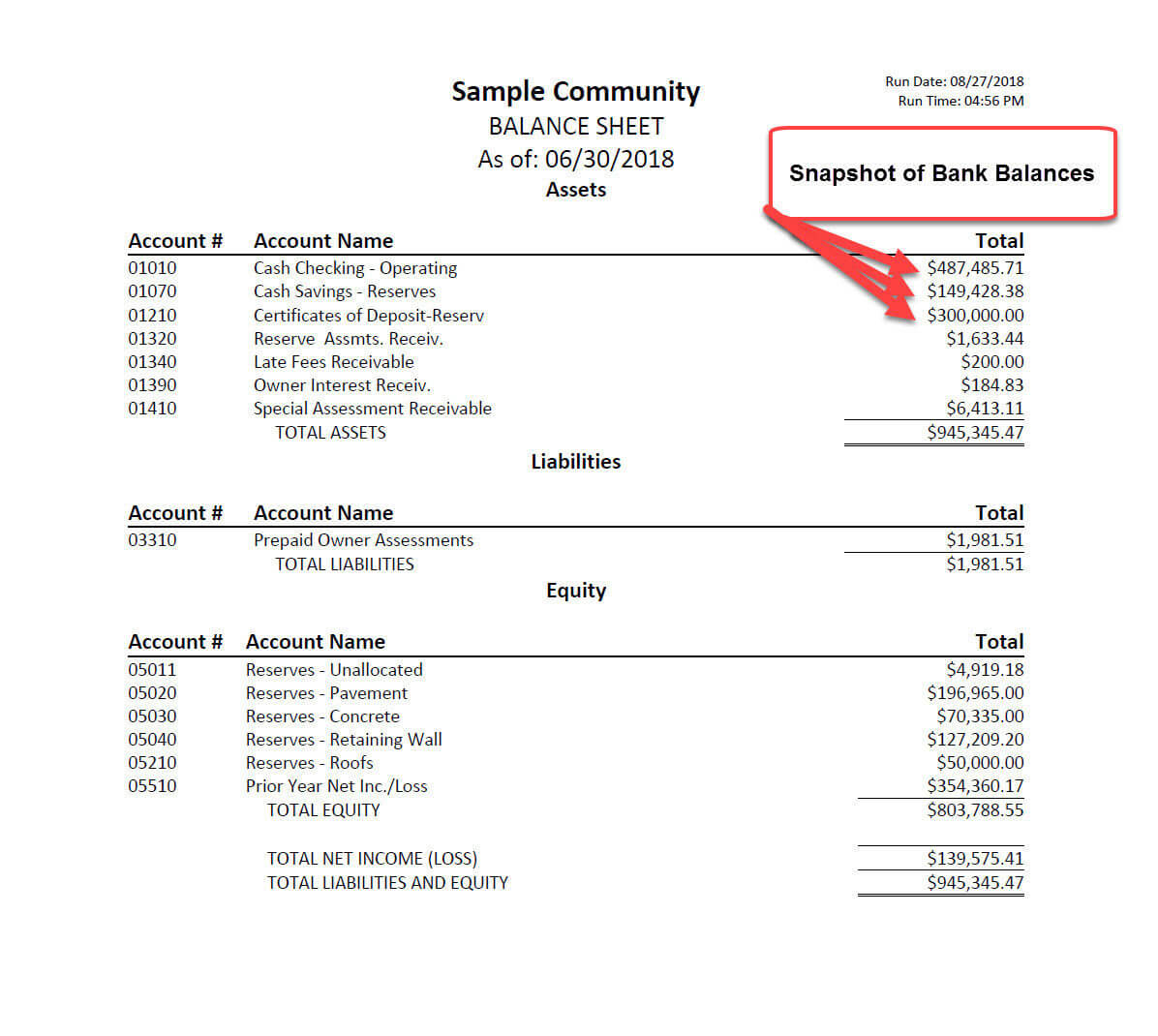

HOA Financial Report #3 – Balance Sheet

A balance sheet is an important part of the financial package. It tells where the association stands with their asset, liability and reserves at a particular point in time.

There are three key accounts on a balance sheet that Condo & HOA officials should pay special attention to:

- Cash in the Operating Checking Account – shows ability to meet current operating expenses.

- Accounts Payable – shows how much is owed to vendors and service providers.

- Capital Reserves – shows how much is available for major capital repair and replacement projects in the near and distant future.

Sample Balance Sheet

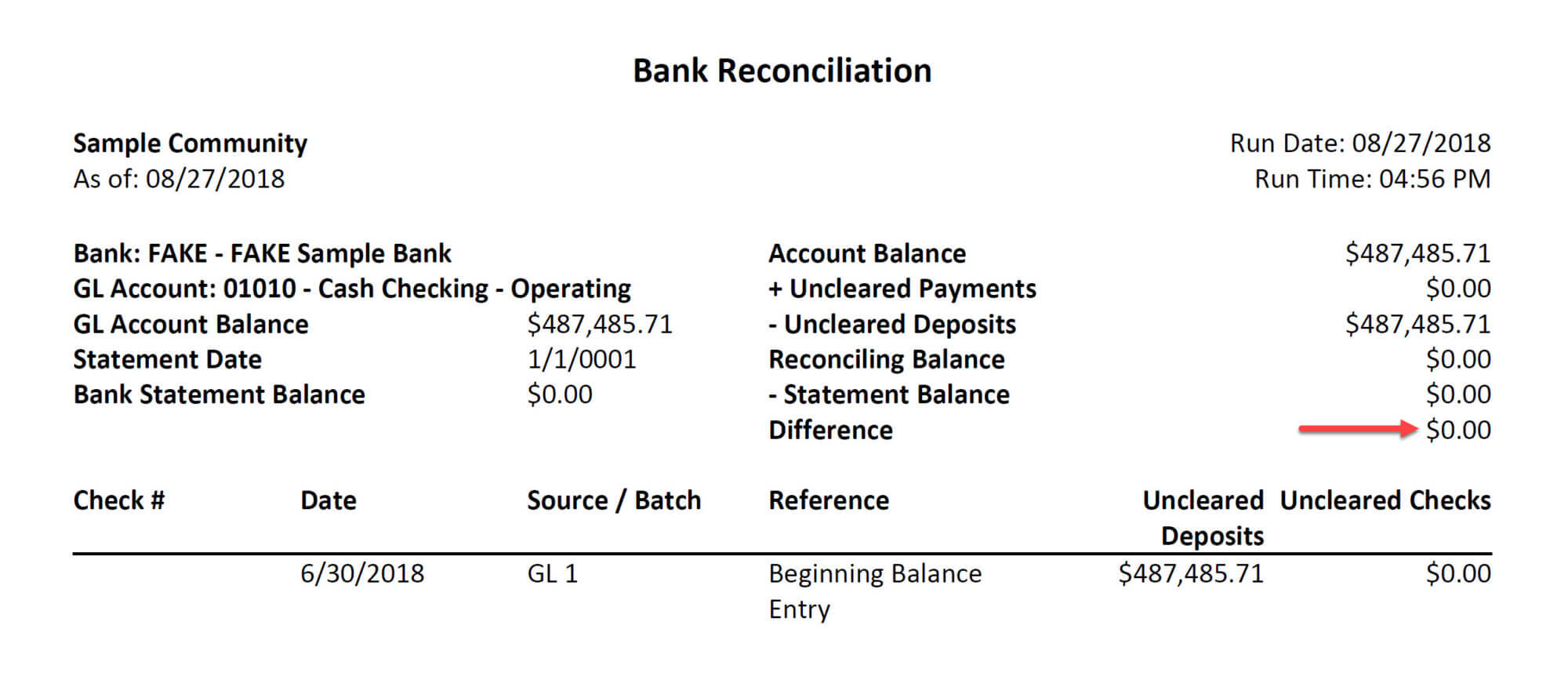

HOA Financial Report #4 – Bank Reconciliation Report

The Bank Reconciliation report is used to “prove” that the cash assets shown on the association’s books and balance sheet agree with what the bank statement shows. The reconciliation takes into account outstanding checks that have not been processed by the bank as well as deposits of cash that have not been processed by the bank. There should not be any difference it should be $0 but if there is a difference it is a flag for you to look into something further. This report is a great tool to ensure you are not a victim of embezzlement (for more on this see my Community Embezzlement Case Studies).

Sample Bank Reconciliation Report

Additional Reports to Consider

Bank Statements

Bank statements are another tool to ensure you are not a victim of theft. Plus you can easily see how much money you have in the bank. Bank statements are easier to understand than the balance sheet since we’re all used to looking at them and they show the current amount of money in the bank account(s), recent deposits and withdrawals.

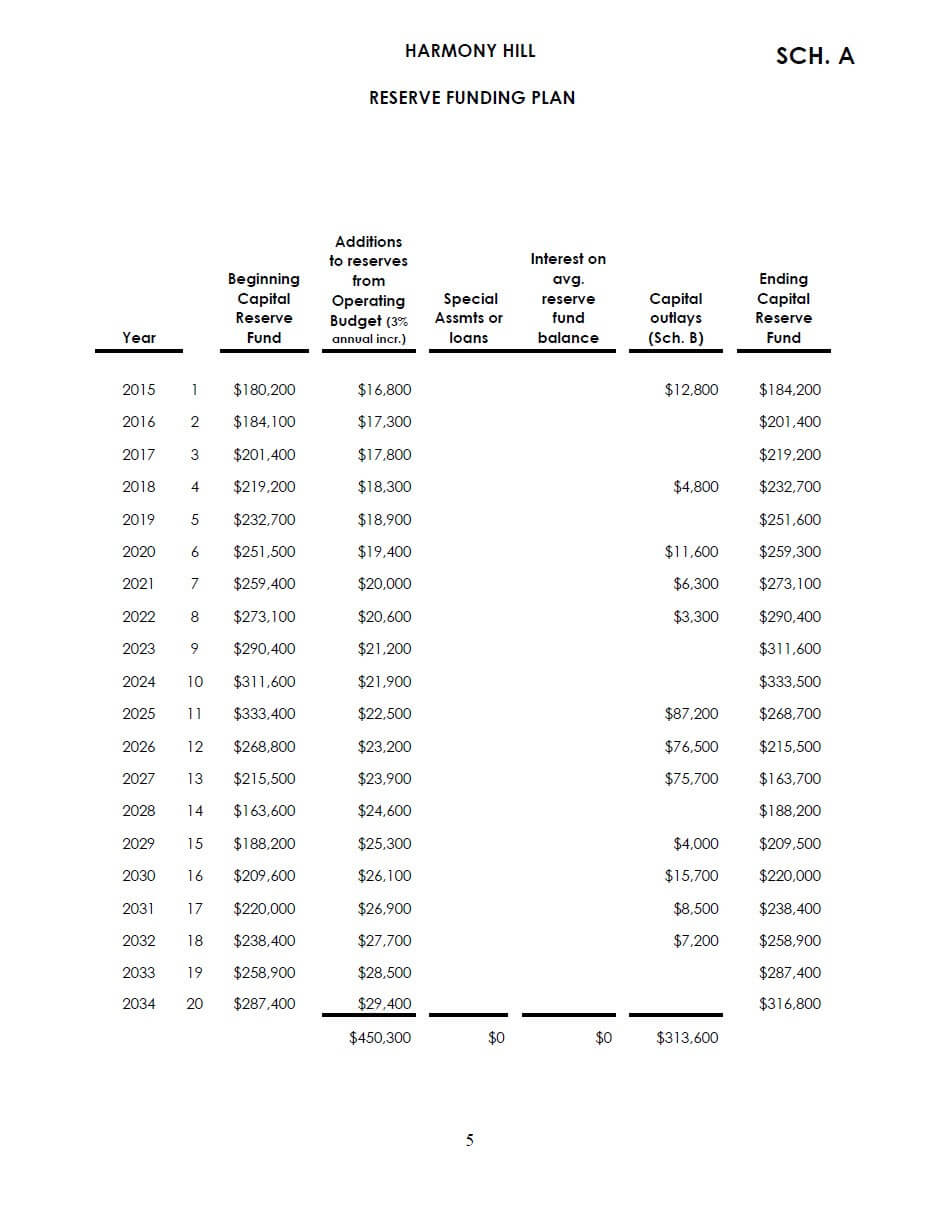

Current Capital Reserve Plan

You don’t need a fancy report but you should have something that shows how much money you have set aside and the anticipated cost for replacements and larger capital projects. This report is far superior than looking at a capital/ reserve bank account which can be deceiving. You may think you have a lot of money saved but if you had a big roofing or paving project it could be wiped out with no funds for other projects.

Summary

As a volunteer board member you only have so much time to dedicate to operating your community. There are emergencies to deal with, vendors, projects and of course financial and administrative tasks. A large part of your responsibility is your fiduciary responsibility to the community. Overseeing that the community funds are safe and being spent properly is of high importance. To simplify this task we highly recommend you make sure to review our top 4 financial reports for HOAs and condo communities.

Of course our service offers a host of condo / HOA financial reports that serve a supporting role to our top 4 which allow you to drill down for greater detail.