The annual tax return is a confusing topic for many HOAs and condominium associations. State and federal statutes require all associations to file tax returns every year. But that doesn’t mean that all do and that creates a risky situation for any association that doesn’t file. Let’s take a look at the rules, risks, and possible penalties for filing or not filing a timely and accurate tax return for your HOA or condominium association.

Dispelling HOA Tax Season Misconceptions

The annual tax return is a confusing topic for many HOAs and condominium associations. State and federal statutes require all associations to file tax returns every year. But that doesn’t mean that all do and that creates a risky situation for any association that doesn’t file. Let’s take a look at the rules, risks, and possible penalties for filing or not filing a timely and accurate tax return for your HOA or condominium association.

A common misconception for some HOA and condominium associations is that since they are “not for profit” corporations, they have no need to file any tax return. However, that is not the case. All corporations have to file state and federal tax returns even if they are “not for profit”. They can file it themselves or they can hire an outside expert to handle the task. Failure to file either state or federal can lead to fines and penalties. Depending on what types of income is overlooked or improperly reported those fines and penalties can be significant. In worst-case scenarios, the association could lose or have its status as a corporation suspended, create havoc, and lose the ability to function as a corporation.

Another common misconception is what qualifies as taxable income for an HOA or condominium association. Most associations are only taxed on non-member income – interest, leasing of clubhouse amenities, anything that isn’t basic common fees, and assessments can be subject to tax. Additionally, deductions against these income items may qualify the association to not have to pay tax or reduce the amount of tax burden. Regardless, even the smallest of associations does have to file a tax return, even if that tax return shows $0 in taxable income. Even less common unincorporated associations have to file a federal tax return.

So When is My HOA Tax Return Due?

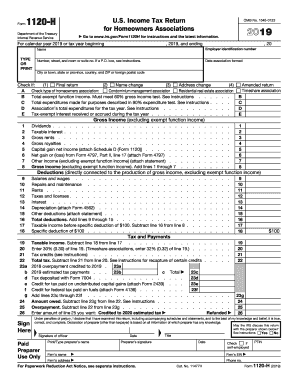

Depending on what your fiscal year-end is, your tax return is due three and one-half months after your fiscal year-end. Many Associations were set up using a calendar year-end so the traditional April 15th date is common. That will vary for associations that use other year-end dates but it will always be three and one-half months from the fiscal year-end date. For most associations, taxes are filed using IRS Form 1120H. You can find a copy on the IRS website at https://www.irs.gov/forms-pubs/about-form-1120-h.

What about state tax returns?

Do you need to file a state tax return as well? South Dakota and Wyoming do not levy a corporate income or gross receipts tax. Nevada, Ohio, Texas, and Washington impose a gross receipts tax instead of a corporate income tax meaning you still need to file with the state every year. All other states require you to file as that is how the states keep track of corporate income taxes owed. The general rule of thumb is that any state that has an income tax or a gross receipts tax will require an HOA or condominium association to submit a state filing.

What if I Need Help with My HOA or Condo Association Tax Return?

Outsourcing your tax return is a common policy for HOAs and condominium associations unless there is expert help on staff or the service is provided by the association’s managing agent. The cost of the return preparation will vary by the size of the return and the number of man-hours needed to complete the return. Just like preparing a personal return, it takes less time the more prepared you are as the return is processed. Using an outsourced HOA and condominium association record and bookkeeping service like Community Financials is one way to make sure your tax return preparer has all of the relevant financial records available to make short work of preparing your HOA or condominium association tax return.

As an additional reference, we highly recommend your take a few minutes to watch and review our excellent “Ask an Expert” video below, featuring Russell Munz of Community Financials and tax expert Jeremy Newman, CPA, and Owner of Newman Certified Public Accountant, PC.

If you have specific tax questions about your community, your state’s filing requirements or filling out the 1120H we recommend you talk to your association’s tax accountant – or reach out to Community Financials, and we can help breathe new life into your HOA’s accounting and bookkeeping.