How Does Transitioning HOA or Condo Community Accounting Work?

Some Boards are hesitant to change accounting mid fiscal year. The fear may be that the accounting for the fiscal year end will be convoluted or inaccurate and can interfere with a year-end audit or tax filing. Or the fear may be that it is a lot of work. You don’t have to fear the mid-year accounting change. To help explain I will answer the question: how does transitioning HOA or Condo Community accounting work?

A “transition” is the process when a community switches from one way of doing business to another. This can be switching from a self-managed board volunteer doing the accounting work or a community changing from full-management to self-management (read our post on transitioning away from your current manager) or other communities splitting up the accounting from their management company (read more here). In all of these situations a new financial management company, like Community Financials, will be setting the community up in its accounting software and handling most of the details.

How long does a transition take? Typically it take a month but we have also had communities sign up and we start the following week. Transitions typically include changing the collection process, bill payment process and financial reporting systems.

Collection changes are typically new owner charge statements or coupons with a new lockbox code on the bottom of a remittance slip that helps with checks deposited to a lockbox (a bank’s automated deposit mechanism). The lockbox will typically require a new 10 digit numeric code that the lockbox scanners can read and help digitize payments. This new 10 digit number will be the homeowner’s new account number. If a homeowner uses their bank’s bill pay they will have to delete out the former bill pay and set up a new bill pay with their new account number and mailing address for the lockbox. Next a new collection process will provide online payment options. The owner will have to register for the new system, creating their unique login and will gain access to view their charges, payment history and make payments. To communicate these changes we mail detailed instructions to the owners.

The collection process in many cases includes changing the bank operating account which provides the lockbox service, online payment functionality and increased transparency for the board. Depending on the bank, the financial manger uses, there is typically $0 monthly bank fees for these services. Several board members will become signors on this new account and be given view access to the bank accounts and bank statements online.

For paying association bills there is also a few changes. Our company, Community Financials, offers an online bill review and approval system. All a board needs to do is provide a vendor list and then we mail the vendors letting them know the new address to mail their bills to. Then we typically set up the Board Treasurer and President in our online system to review and approve bills online. Lastly, we provide instructions and answer any questions they have to complete their set up.

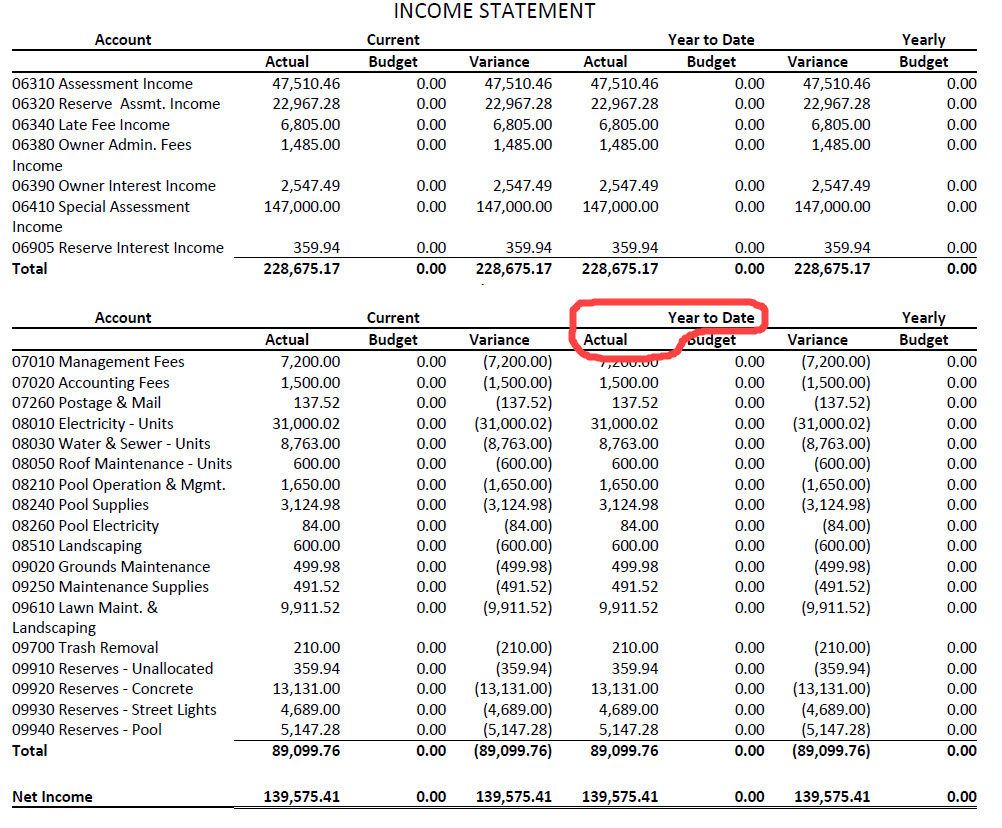

Finally is the financial reporting. This is where we find most boards fear the change. How will a Board be able to do an audit or file taxes at year end if they make a change mid-fiscal year? The answer is pretty simple. We take the last closed period’s financial reports and recreate that information in our accounting software. The most important part of this is we take the year to date balances off those reports and enter them into our system. This allows us to generate year to date financials that are accurate and pick up exactly where your old accounting left off.

Additionally, if an auditor wants to look at prior period financial information you will have those reports and invoices from the board member who prepared them or the prior management company.

I hope this post answered your question of how does transitioning HOA or Condo Community accounting work? I’ve been in this industry since 2001 and have transitioned many communities. We have a good on-boarding process with instructions for owners and boards to help communicate the change and provide training. If you have further questions about transitioning your community please reach out to us and we’ll be happy to have a discussion.