How Does Reporting Delinquent HOA and Condo Owners to a Credit Rating Agency Work?

There are always some owners that don’t pay their Homeowner Association (HOA) or Condo charges on time. Some owners don’t pay for many months – and the list of delinquent owners and the amount of money owed gets larger when there is a recession. The amount of uncollected money causes a financial problem and risks reducing services to other owners. One powerful way to reduce delinquencies is to impact their credit score. So how does reporting delinquent HOA and Condo owners to a credit agency work?

Everyone has bills to pay. After paying for food, the mortgage, utilities, car loan and credit cards get paid first. You know which bills are often last in line to get paid? You guessed it the HOA or Condo charges. Do you know what the bills that get paid first have in common? They all report delinquent payers to credit agencies and cause the person’s credit score to go down if they pay late. We all know that lower credit scores result in the reduced ability to get a loan and increases the associated interest rates.

How it Works

The entire association signs up for the service. Owners that pay late are charged a collection cost for each month they are delinquent. Their delinquency is then provided to the credit agency every month (until it is current or the board approves a payment plan). This monthly reporting will cause their credit score will go down. Other owners that paid on time will have their credit score go up for free (see a neat video from Shark Tank’s Kevin O’Leary about that here). The HOA or Condo’s name will show as the data furnisher on the credit report.

How Can You Sign Up?

The association signs up for this service through a credentialed data furnisher such as a financial management company (like our firm Community Financials) or property management company. These firms and their practices have gone through a physical inspection and interview to be vetted by Equifax and become a data provider through a third party like Sperlonga Data & Analytics.

Recommendations

Send out a notice of when this new service will start along with the associated costs for delinquent payers to all owners. Then give a 30 day grace period for owners to get caught up. You will be amazed at how many payments come in over this 30 day period.

Results

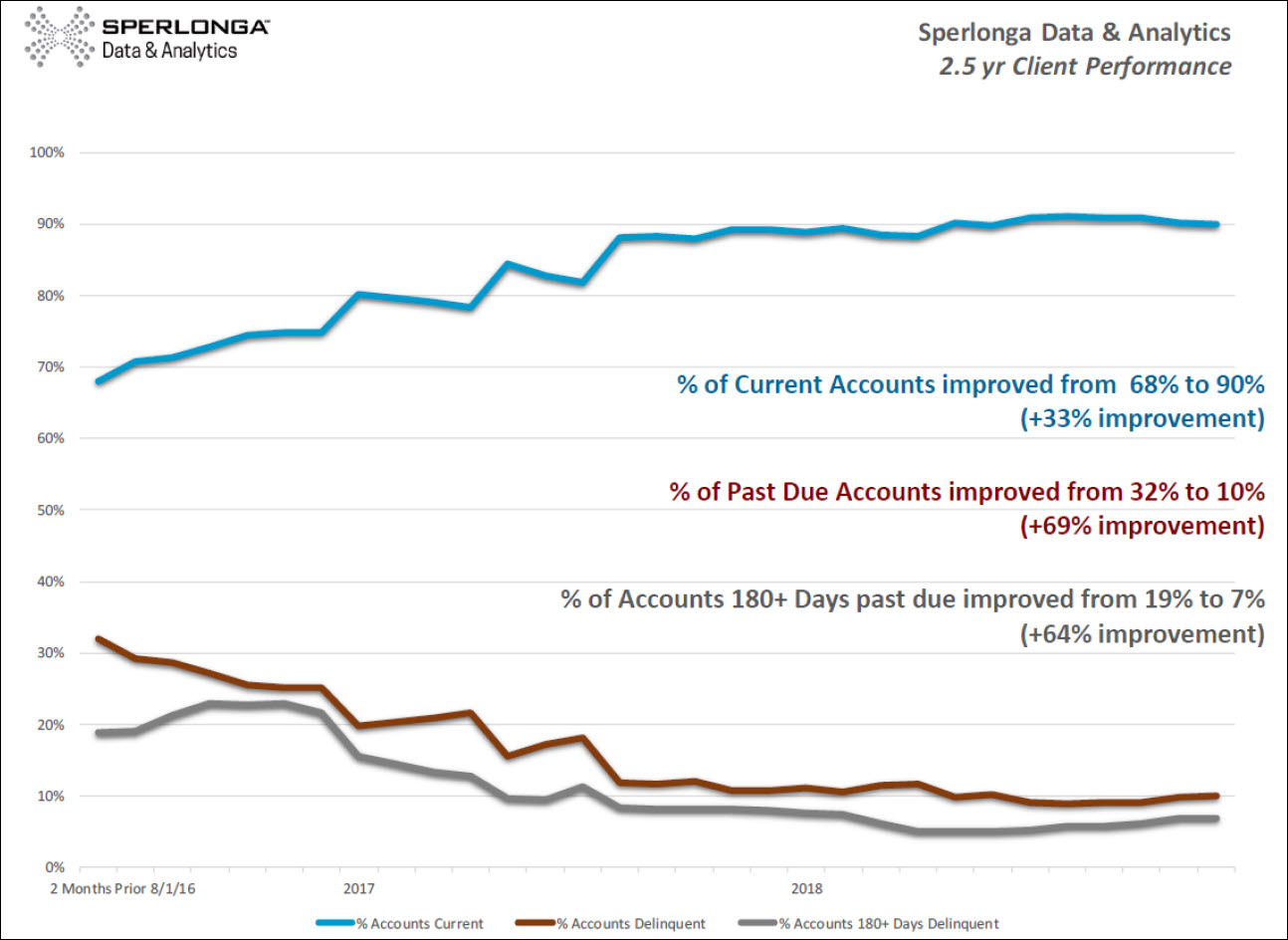

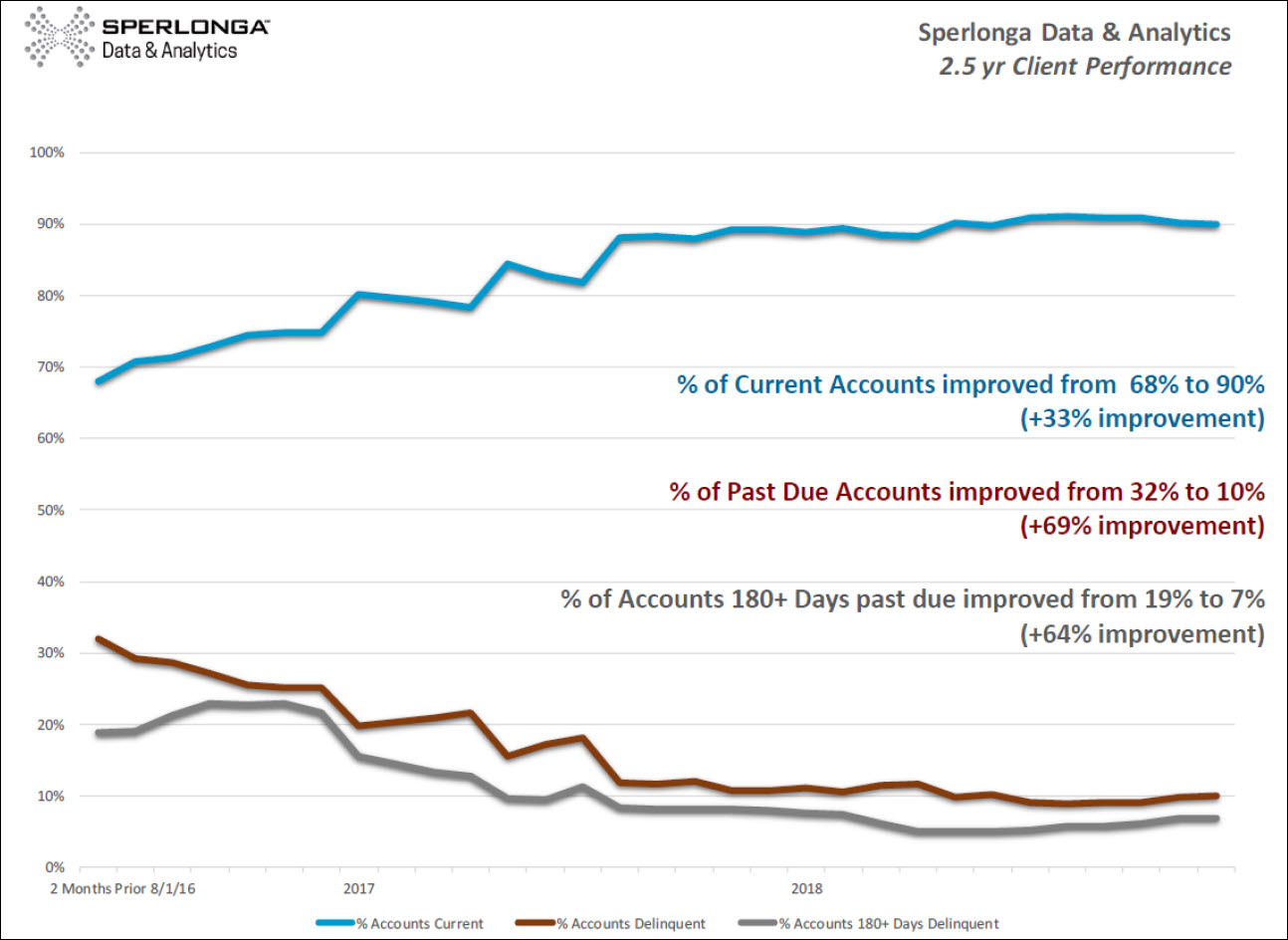

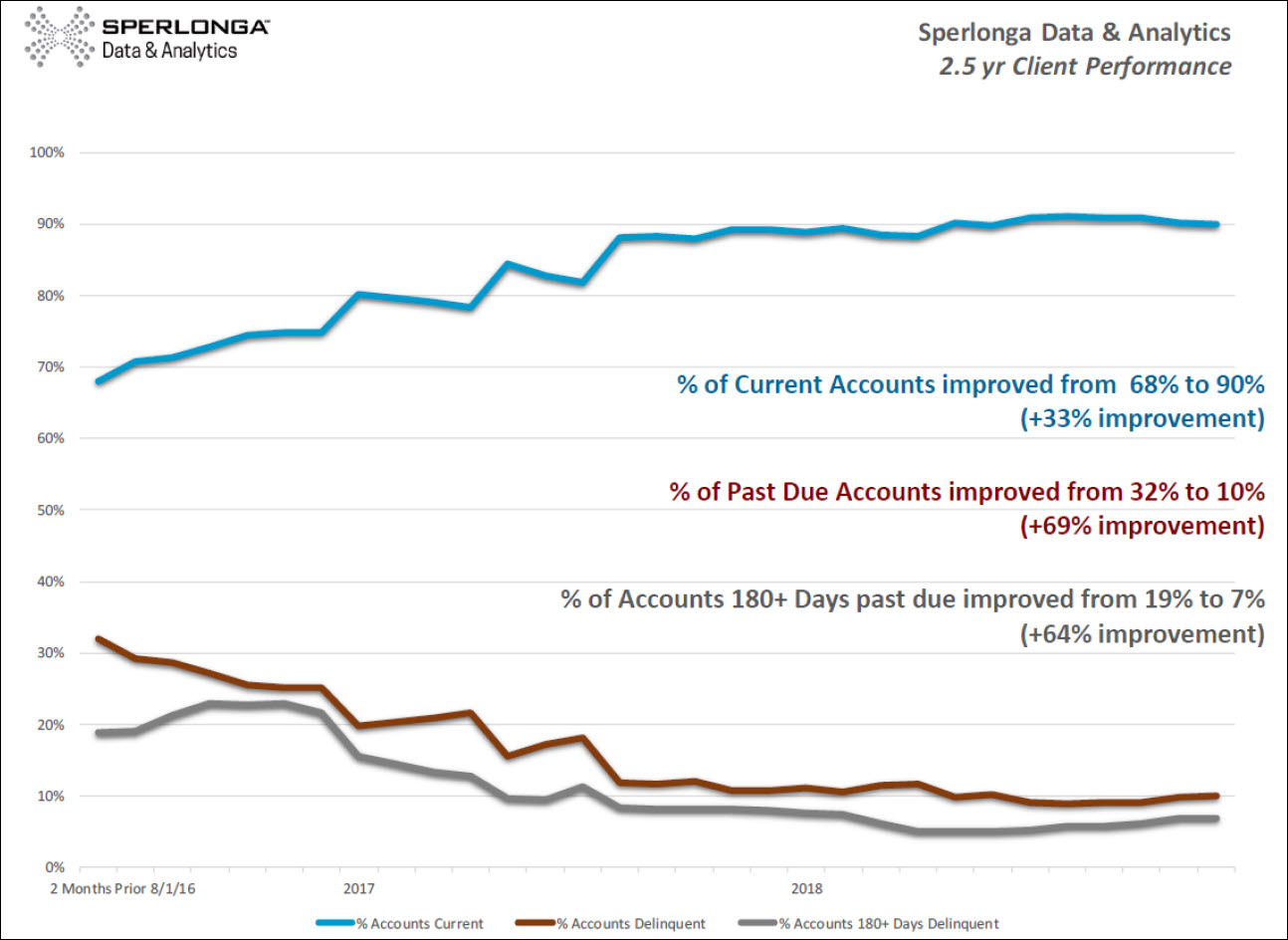

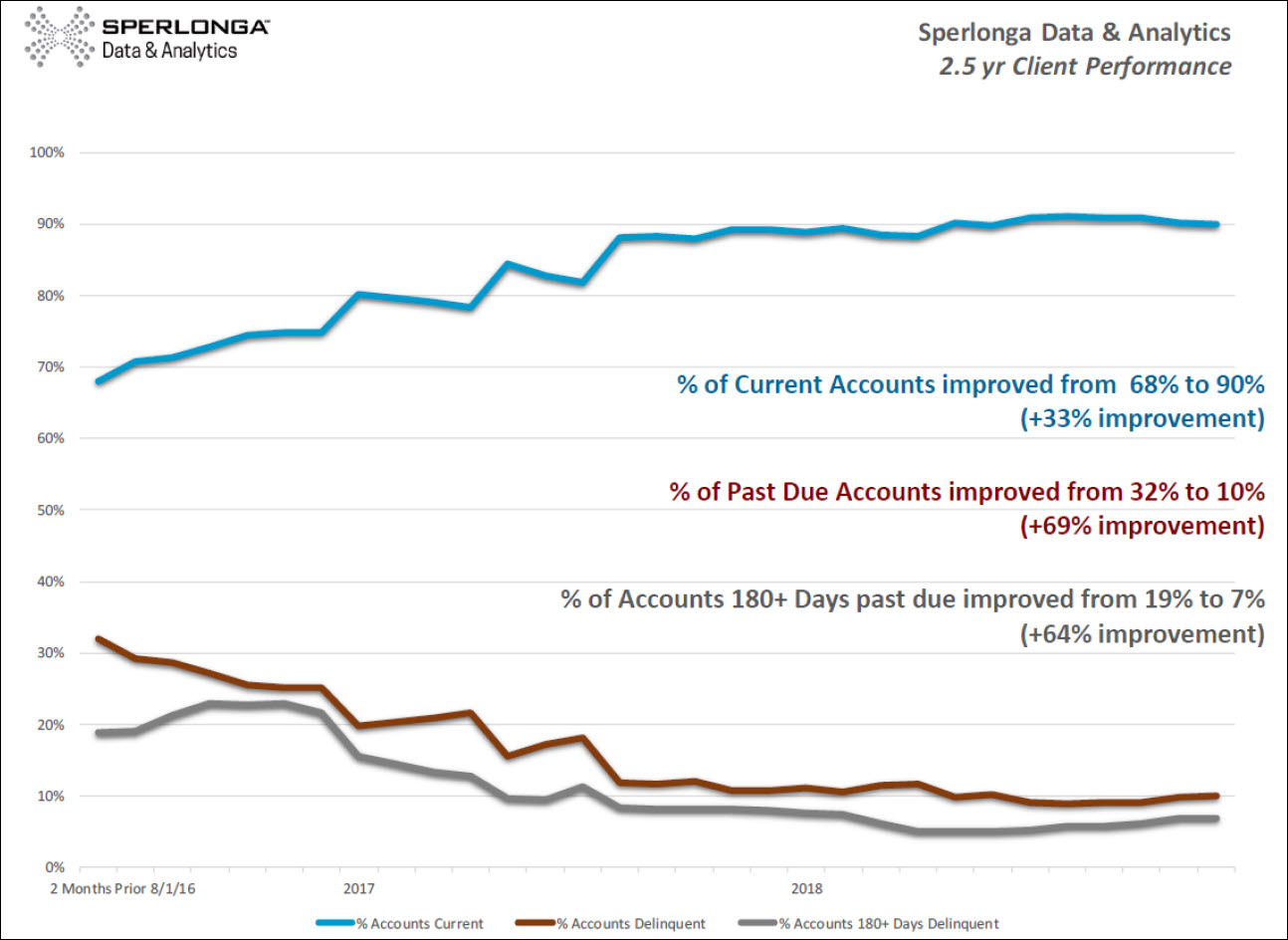

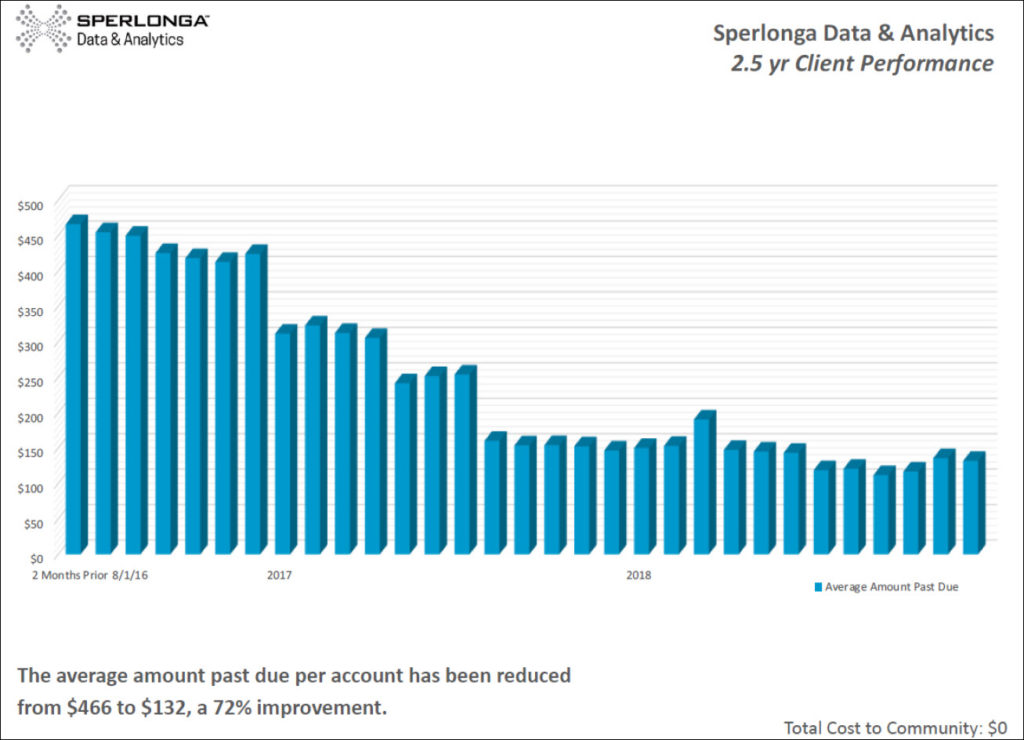

Assessment payment reporting for HOAs nationwide started in 2016. Here is an average over the last 2.5 years:

- 35% annual reductions to delinquent account balances

- 21% reductions to the number of delinquent accounts reported

- Current accounts rose from 68% to 90%

- % of delinquent accounts dropped from 32% to 10%

- % of 180+ past due accounts dropped from 19% to 7%

With improved collections and reduced delinquencies your community will be in a stronger financial position. They improve the community’s chances of obtaining future capital improvement project loans at lower interest rates. And you may use the collected monies to increase your reserves and/ or hold off a dues increase. All of these together: reduced delinquencies, increased reserves and reasonable assessments increase property values.

We hoped you enjoyed: How does reporting delinquent HOA and Condo owners to a Credit Agency Work? If you are interested to learn more about this great tool for improving cash flow and reducing delinquencies for your Homeowners Association (HOA) or Condominium Community please schedule a quick call with Community Financials.