Your Condo Association Tax Filing Checklist for a Stress-Free Year-End

Tax season might not be top of mind for most condo boards, but when it comes to condo association tax filing, early preparation makes all the difference. Every association – regardless of size or income level – is required to file a federal tax return each year, and waiting until the last minute can lead…

Tired of HOA Headaches? Discover the Secret to Stress-Free Management

Are you tired of the top two problems plaguing the HOA industry: unresponsive service and shoddy accounting? Are you frustrated by unreturned calls, inaccurate financials, and the constant struggle to get things done? You’re not alone. Many HOA board members and homeowners face these challenges, but there’s a better way. Introducing a New Standard in…

Community Financials Goes to CAIs 2025 National Conference & Exposition

On May 8th and 9th 2025, Chris Elmore (Sales Director) and I joined 2,500 other attendees at the Community Association Institute Annual Conference & Exposition in Orlando Florida. This event is geared towards community managers, and the expo is packed with vendors that cater to Community Associations. I wanted to connect in person with our…

HOA Never Filed a Tax Return? Here’s What to Do Next

If you’ve just discovered that your HOA never filed a tax return, it can feel overwhelming – but it’s more common than you might think. Whether due to a lack of clear guidance, volunteer board turnover, or just an honest oversight, plenty of associations find themselves in this exact situation. The important thing now is…

HOA & Condo Finances: Why Lines of Credit Can Be a Trap (and Smarter Alternatives)

As Board Members of Homeowner Associations (HOAs) and Condominiums, you’re constantly navigating financial complexities. A frequent question is whether a revolving line of credit (LOC) is a sound strategy. While seemingly flexible, LOCs can pose risks to your association’s long-term financial health. Let’s explore why and discuss more prudent alternatives. The appeal of a LOC…

How to Improve HOA Financial Management Without Overwhelming Your Board

Let’s face it – HOA financial management is rarely why someone joins the board. But staying on top of your community’s finances is one of the most critical responsibilities you’ll have. Still, it doesn’t need to be a constant source of stress. If your board is buried in spreadsheets or playing catch-up with budgeting and…

Budgeting for HOA and Condo Insurance in 2025: A Practical Guide

Managing insurance costs is becoming more challenging for community associations. To help you navigate these waters, we’ve put together a guide based on insights shared by insurance expert Dave Pilon, CPA, CFA, CIRMS, at a recent Community Association Institute (CT Chapter) Symposium. This guide covers key strategies for budgeting for HOA and condo insurance in…

Navigating HOA Management: Exploring Alternatives to Full Professional Management

Many Homeowners Associations (HOAs) face a common dilemma: how to achieve effective management without incurring the significant costs associated with full professional management. While self-management can seem appealing, it often places a heavy burden on volunteer board members. Fortunately, there are viable alternatives that offer a balanced approach. This topic was discussed in a podcast…

Why Small HOAs Need Professional Bookkeeping (And How It Saves Money)

Small HOAs, Big Financial Responsibilities A small homeowners association (HOA) may oversee just a handful of homes or a small condo complex, but its financial responsibilities are just as important as those of a larger association. While “small” can mean different things to different communities, it generally refers to HOAs and Condo Associations with anywhere…

Reading HOA & Condo Financial Reports Can Be a Foreign Language to Some – Learn How to Read Them on March 26, 2025

If you are not used to looking at financial reports they can seem as confusing as a foreign language. If you have limited time as a HOA or Condo volunteer or are a busy Manager what reports should you review before your meeting and what do all the numbers mean? Join us to learn about…

The Importance of a Surveillance Policy in Condominium Communities

Surveillance cameras are increasingly common in condominium communities, offering a layer of monitoring for various purposes. However, it’s important to differentiate these from security cameras, as the presence of surveillance video is primarily for rule enforcement, not safety. Attorney Kristie Leff of Bender Anderson & Barba P.C in North Haven, CT advises that associations establish…

Corporate Transparency Act February 2025 Update: What HOA and Condo Boards Need to do Before March 21st

Recent Update: Filing Deadline Extended – March 21, 2025 HOA and Condo Boards, take note! The filing deadline for the Corporate Transparency Act (CTA) has been extended to March 21st, 2025. This extension, announced by FinCEN on February 19th, gives community associations extra time to comply with the Beneficial Ownership Information (BOI) reporting requirements. But…

The End of Tops Pro Software Support: Important Changes Ahead

I recently spoke with a representative from Tops/Enumerate, confirming that support for Tops Pro software – via calls or emails – will end after July 1, 2025. There have also been no recent patches or upgrades. They also said customers are strongly encouraged to transition to a different software solution before this deadline to ensure…

Do’s and Don’ts for Updating HOA and Condo Rules and Regulations

When updating or creating rules for a community association, it’s essential to ensure the rules are clear, enforceable, and legally compliant. These guidelines can help you craft rules that are both fair and effective for your HOA or Condo. Do: Use Clear, Direct Language Clarity is key when drafting community rules. Avoid vague language like…

The Hidden Cost of HOA and Condo Board Duties: How Time Spent Impacts Your Life and Organization

As a board member time is one of your most valuable assets. However, many board members find themselves buried under the demands of meetings, reporting, and administrative tasks. One customer recently shared how they were spending over 30 hours a month on board responsibilities—time they believed could be used more effectively. Their goal? To find…

RevoPay Exiting HOA Online Payments Market Ahead of Changing Security Requirements

For some of Community Financials’ customers we have used RevoPay to help with encrypted online payment processing. They handle e-checks and credit card transactions. Their system plugs into our accounting software and is a “behind the scenes” part of our homeowner online payment solution. RevoPay was founded in 2002 as a cloud-based e-payments software and…

Corporate Transparency Act Blocked: What It Means for Community Associations

In a significant development, the U.S. District Court for the Eastern District of Texas issued a preliminary nationwide injunction on December 3, 2024, halting the enforcement of the Corporate Transparency Act (CTA) and its beneficial ownership information (BOI) reporting requirements. This ruling blocks the requirement for businesses, including community associations, to file their BOI reports…

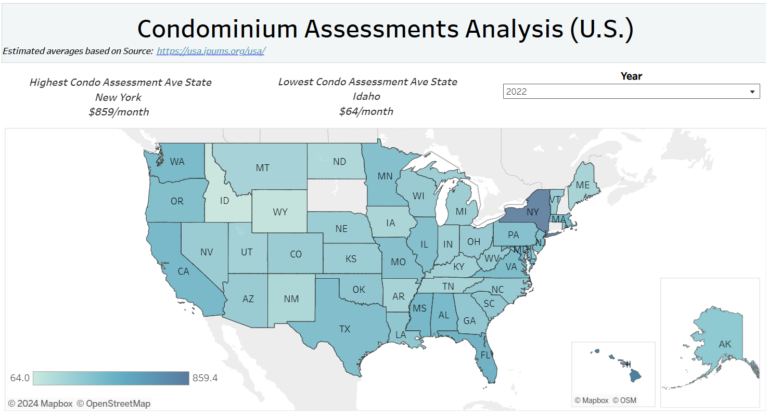

See How Your HOA or Condo Dues Compare to the Average in Your State

Community association boards and property managers understand how crucial it is to set fair and sustainable condominium assessments. However, knowing whether your assessments align with the market or need adjustment can be challenging. Thankfully, the Foundation for Community Association Research has developed an invaluable tool to assist you in comparing your condo dues to those…

Corporate Transparency Act Update: What HOA and Condo Boards Need to do before Jan 1, 2025

On October 11, the Alexandria District Court held a preliminary injunction hearing in Community Associations Institute (CAI) v. U.S. Department of Treasury, a pivotal case challenging the Corporate Transparency Act (CTA). CAI has been fighting to protect community associations from the burdensome requirements imposed by the act. A crucial update came on October 24 when…

2024 California HOA Regulation Changes Every Board Should Know

Navigating California’s complex HOA regulations can be challenging for board members and community managers. Staying compliant with the latest legal updates is crucial to maintaining smooth operations and protecting the interests of homeowners. With the introduction of significant changes to California HOA laws in 2024, it’s more important than ever to understand how these regulations…

Blog posts and webinars helping you navigate HOA financial management

You can find an extensive library of HOA resources here at the Community Financials Blog. Updated regularly with articles of interest to anyone on the Board of an HOA or Condo Association (or thinking of joining one!), it is guaranteed to have insight on any related subject that you are seeking out.

- HOA financial management, bookkeeping, auditing, and collection practices— our curated Blog section features posts and webinars that aim to answer your most burning questions.

- We also explore common topics such as, but not limited to, HOA tax returns, Board elections, and more!

- Bookmark it today for your one-stop resources source.