Does a Two-Column Balance Sheet for HOAs and Condos Simplify Reporting?

Community Financials has introduced a two-column Balance Sheet format that separates Operating and Reserve Funds, providing a clearer picture of the financial position for homeowners’ associations (HOAs) and condominiums. This blog explores how this new format differs from a traditional Balance Sheet, how to read it, and why it simplifies understanding for board members.

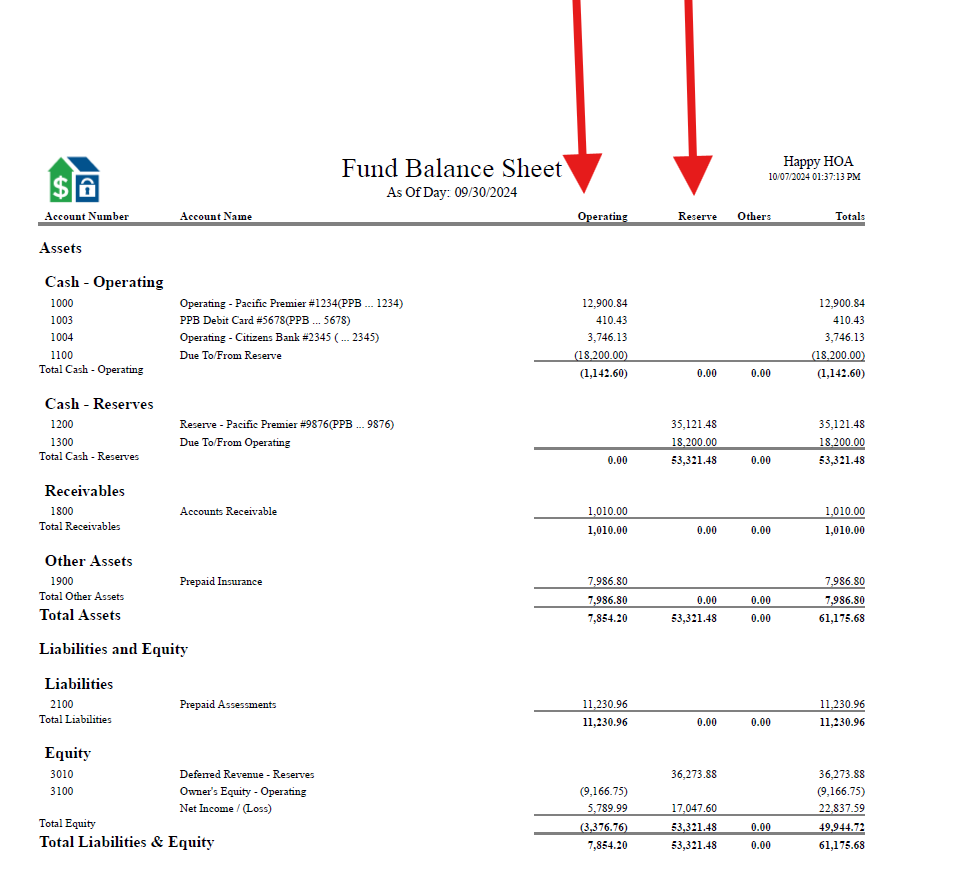

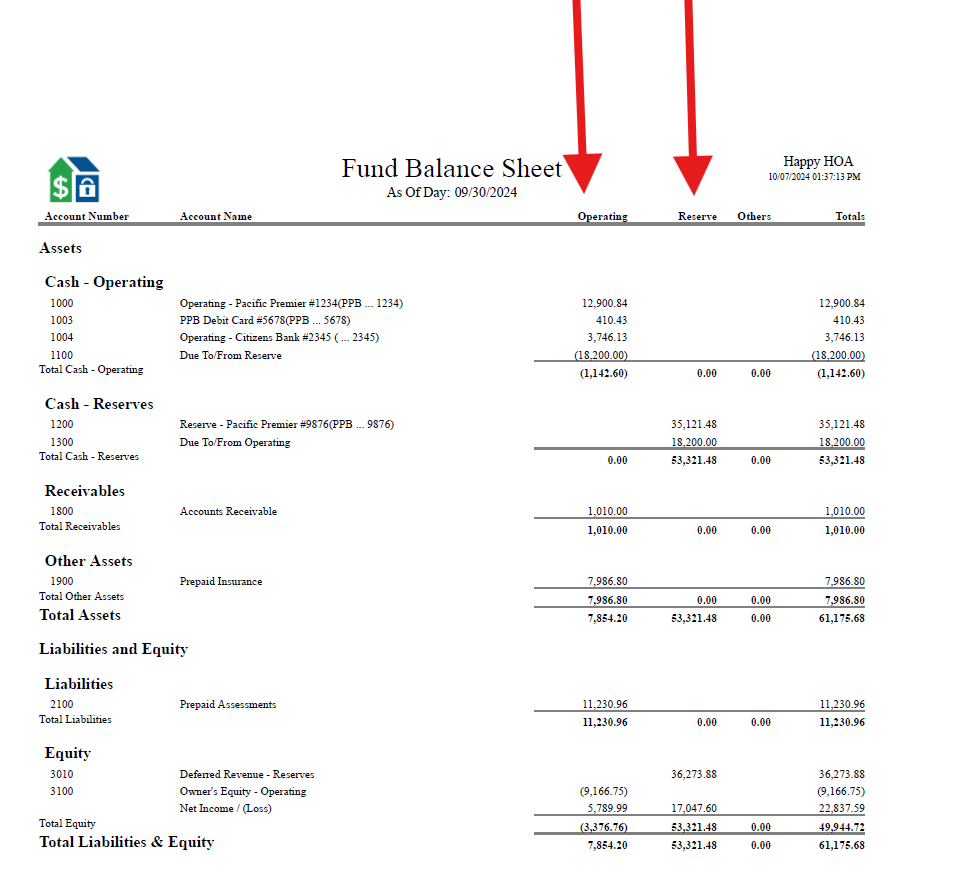

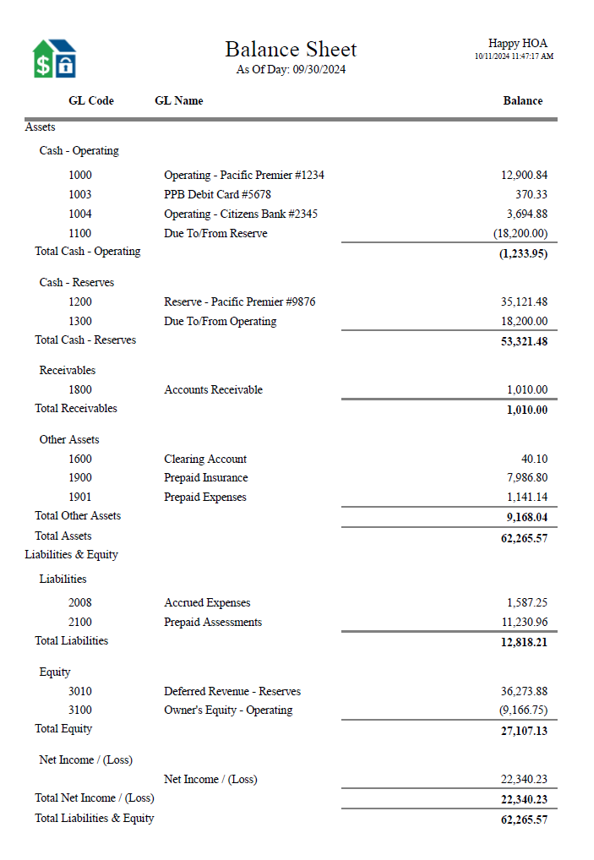

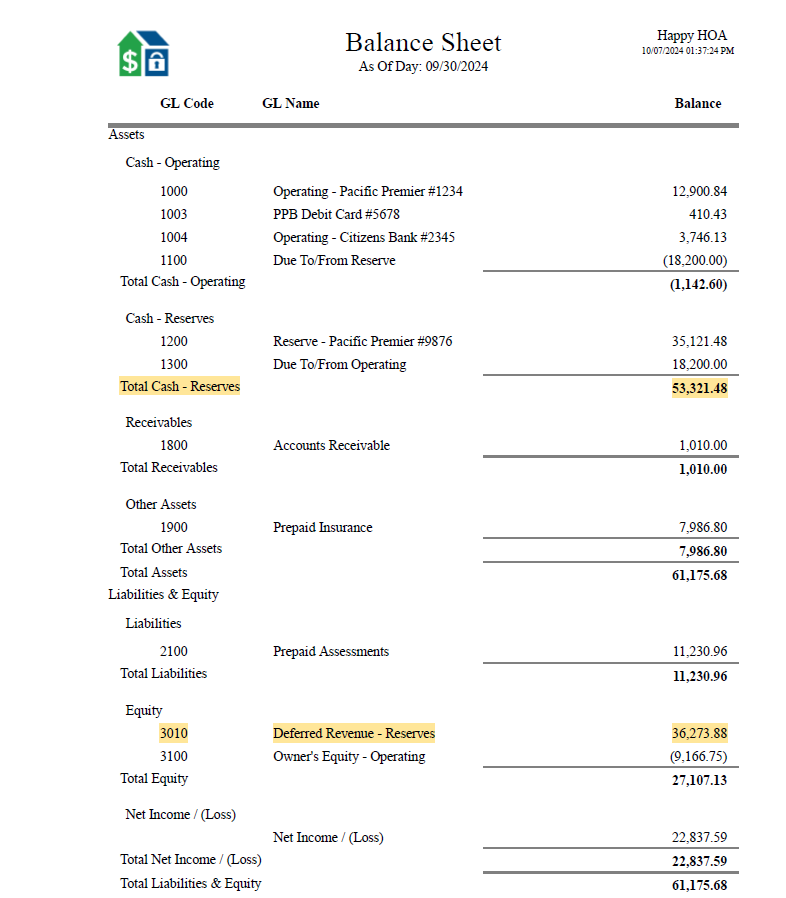

How It Differs from a Traditional Balance Sheet

The primary distinction between the two-column Balance Sheet and a traditional one is the separation of funds.

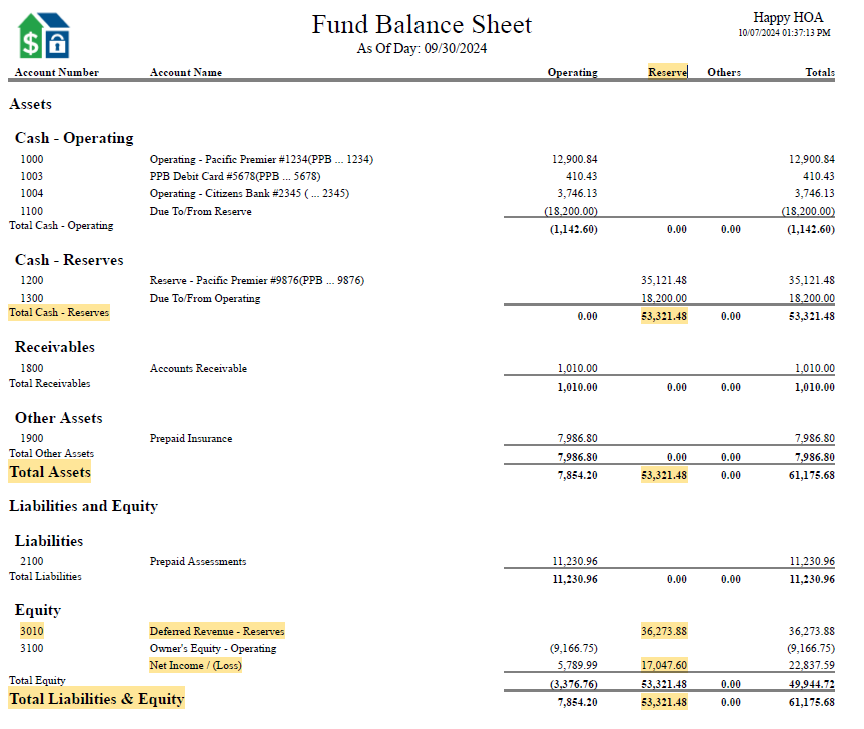

Two Distinct Columns: In the new format, Operating and Reserve Funds are presented in separate columns. This allows for immediate visibility into each fund’s financial status. In contrast, a traditional Balance Sheet combines all financial data into a single column, making it harder to discern specific fund performance.

Streamlined Information: The traditional format often requires reviewing multiple documents to understand financial health. The two-column layout consolidates information, presenting a comprehensive view on one page.

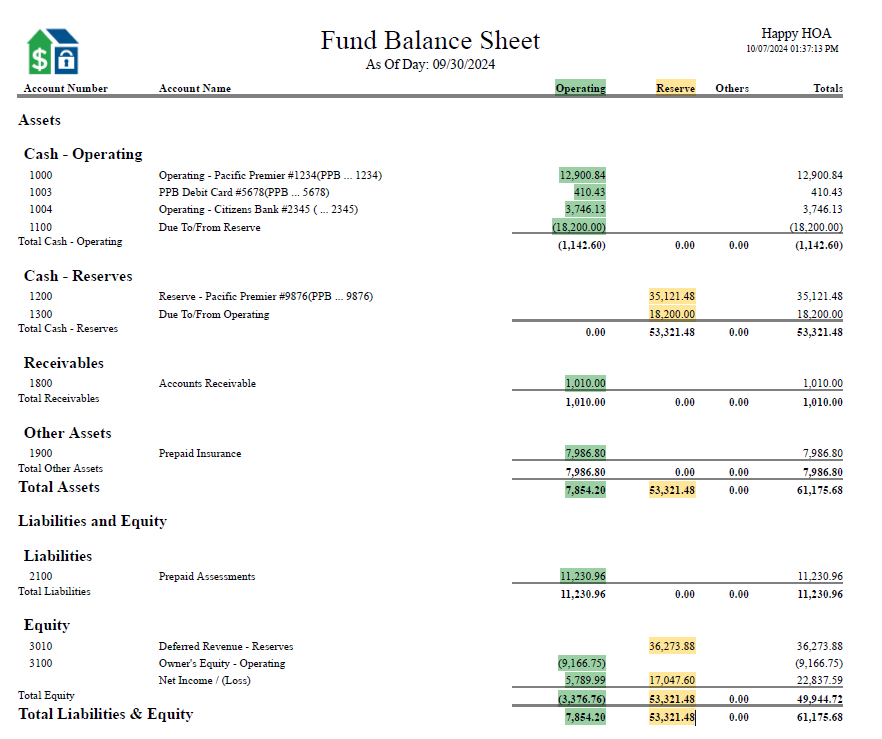

How to Read the New Balance Sheet Format

Operating Column

- Color-Coded in Green: This column displays all Operating Income, Expenses, Equity, and Liabilities. It includes key items like Operating Cash and receivables.

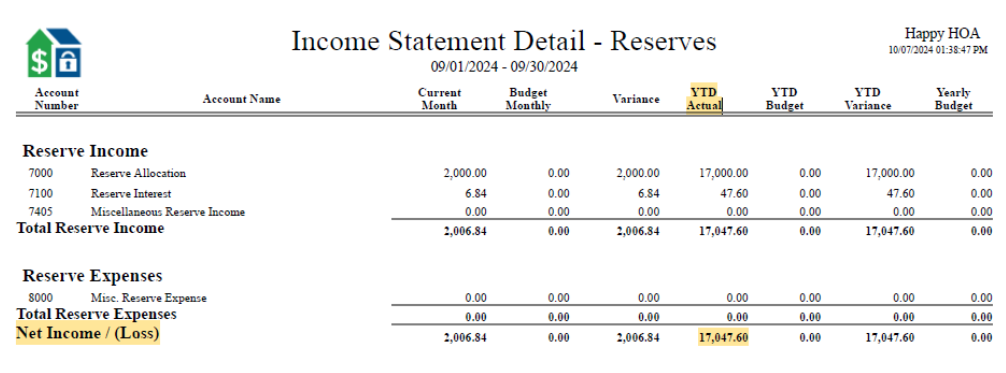

Reserve Column

- Color-Coded in Yellow: This column contains Reserve Income, Expenses, Equity, and Liabilities, featuring Reserve Cash and related liabilities.

Overall Structure

The Balance Sheet summarizes the association’s assets and liabilities as of the report date, typically generated monthly. Key elements include:

- Assets: Listed under Operating and Reserve categories, covering Cash, receivables, and prepaid items.

- Liabilities: Divided into Operating and Reserve sections, detailing prepaid assessments, loans, and respective equity and net income/loss.

Why It Makes Understanding Easier for Boards

The two-column format enhances clarity and comprehension for board members in several ways:

- One-Page Overview: Critical information is presented on a single page, reducing the complexity often associated with financial reports.

Visibility of Net Income/Loss: Both Operating and Reserve net income/loss figures are shown together, eliminating the need to cross-reference the Balance Sheet and Income Statement. This streamlining allows boards to quickly assess financial health without getting lost in details.

Take Control of Your Community’s Financial Health

At Community Financials, we believe that clear financial reporting is essential for effective management. The two-column Balance Sheet simplifies the process, enabling boards to easily access and understand their community’s financial status.

Ready to take your financial management to the next level? Don’t leave your financial planning to chance. Partner with Community Financials to benefit from our expert services and support.

Let’s get started on enhancing your community’s financial health—fill out our confidential online request for a quote form.