Do HOAs and Condo Communities have to comply with new 2024 FinCEN regulations?

As of January 1, 2024 the Financial Crimes Enforcement Network (FinCEN) will require most legal entities, domestic or foreign, to report their Beneficial Ownership Information (BOI). How will this impact HOAs and Condominium communities? Do HOAs and Condo Communities have to comply with new 2024 FinCEN regulations?

What is the Corporate Transparency Act About?

The Corporate Transparency Act was enacted in 2021 as an anti-money laundering effort to curb entities, both foreign and domestic, and the individuals controlling those entities from violating U.S. laws specifically around illegal money movements. This Act created new reporting requirements for certain types of corporate entities. The Agency that will enforce this is the Financial Crimes Enforcement Network (FinCEN).

Entities registered with a State, including Limited Liability Companies (LLCs), and certain corporations established PRIOR TO January 1, 2024, are required to file a Beneficial Ownership Information (BOI) report by January 1, 2025. For entities registered with a State on or after January 1, 2024, the BOI information report is due within 30 days of registration.

Minimum Items Required to Report for Beneficial Ownership*

- Business name.

- Legal name of board members, birthdate, home address, and identifying number from a driver’s license, state ID, or passport.

- Individuals with substantial control. The same information (name, birthdate, home address, identifying number) of person (s) who exercise substantial control over financial reporting for the community association corporation. It is unclear whether a community manager and/or management company qualify as an individual with substantial control. This is yet to be confirmed. CAI will continue to evaluate this and provide guidance accordingly.

In his CAI CT, Volume XIV Issue 8, 2023 Common Interest Article “New Federal Reporting Requirements Apply to HOAs and Their Officers”, Adam Cohen, an attorney with the Law Firm of Pullman & Comley in Bridgeport, CT states: “Beneficial Owners,” which the law defines as anyone who either “exercises substantial control” over it or owns or controls at least 25% of it. “Beneficial Owners” will definitely include the association’s president, treasurer, and any owner of enough units to control at least 25% of the voting interests. Other board members are unlikely to fall within this definition unless they have an unusual degree of unilateral control over the association’s affairs.

Another opinion is that “Beneficial Owners”, for purposes of this law, will include all members of the Board. While certain officers have specific duties and responsibilities in accordance with their position, all Board members vote on management issues and share fiduciary duties.

Changes, corrections, and additions to the filing must occur within 30 days of when you become aware of the change (i.e., board member changes, board member resident address changes, etc.)

* Information gathered from CAI website

Is My Association Exempt from CTA if it Doesn’t Pay Any Federal Income Taxes?

Probably not. If your association has applied for and received tax exemption under Section 501(c), then it is exempt from CTA. Otherwise, your association is not exempt.

One state-specific answer to this question is all Florida condos & HOAs must annually file a Federal corporate tax return regardless of revenue amounts. Associations are not tax-exempt. They do not qualify as IRC section 501(c)(3) organizations.

Why This Report Requires Your Attention

Failure to submit this report may lead to fines of up to $500 per day for ongoing violations in addition to, criminal consequences which may include imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity neglecting to file a mandated BOI report may be held responsible for such lapses.

It May Pay to Procrastinate!

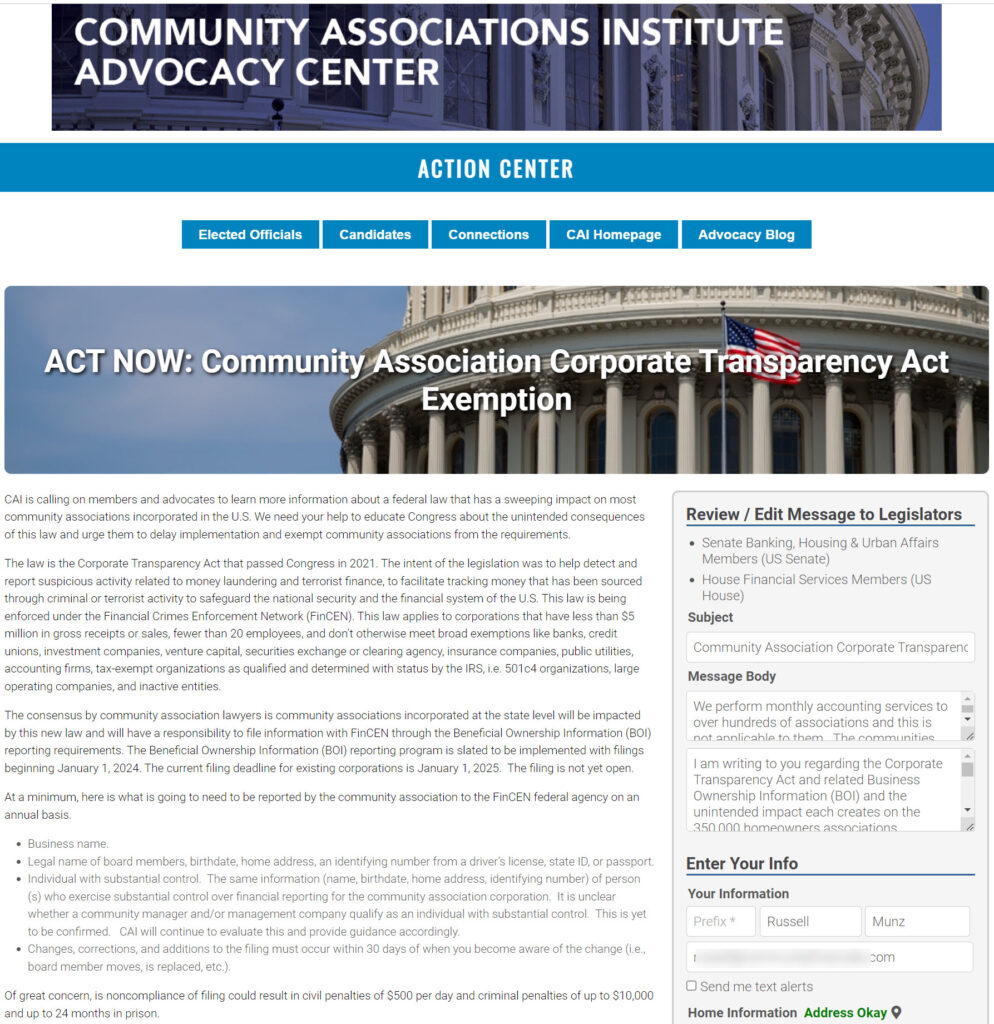

Community Association’s Institute (CAI) is an international organization that provides information, education, and resources to homeowner volunteers who govern communities and the professionals who support them. They also advocate on behalf of common interest communities and industry professionals before legislatures, regulatory bodies, and the courts.

CAI does not believe that the legislation should apply to HOAs. It is actively seeking an exemption or clarification that HOAs are exempt from compliance. Since the filing must be done before January 1, 2025, there is sufficient time to wait to file. Guidance will be provided later in the year to allow CAI to work to get HOAs exempt from compliance.

For more information here is a link to the Community Associations Institute webpage regarding this Act and what they are doing to advocate for HOAs: https://www.caionline.org/Advocacy/Priorities/CTA/Pages/default.aspx

Take Action Today

Here is a link to CAI’s Advocacy Action Center so you can send a message to legislators to exempt Community Associations from this: https://www.votervoice.net/CAI/Campaigns/108066/Respond

The bottom line is to wait to see what unfolds until later in 2024 (unless you are a newly formed entity). Perhaps put this on your Board’s calendar for July to see what the latest is (one source cited the deadline to amend the regulation is 6/30/24). At that time re-visit this website, CAI’s website, and consult with your attorney and or accountant to find out more.

For more research, you may also want to review this Government link: Beneficial Ownership Information Reporting Rule Fact Sheet | FinCEN.gov

March 5, 2025 UPDATE: Federal Court Finds Corporate Transparency Act Unconstitutional what does this mean?